Crypto’s transparency reveals market manipulation that traditional finance hides. Century-old laws riddled with loopholes enable unpunished manipulation.

Opinion by: Nic Puckrin, founder of CoinBureau

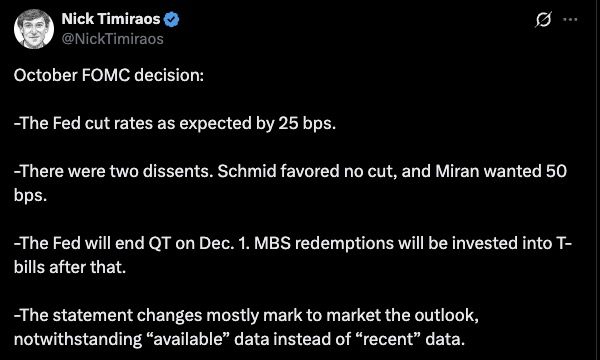

The largest liquidation event in the history of the crypto market, which wiped out at least $19 billion in long positions after US President Donald Trump announced punitive tariffs on China late on Oct. 10, exposed an ugly side of this nascent market: its vulnerability to insider trading.

Onchain data shows that a significant short position was taken out on Hyperliquid just half an hour before the big announcement. Once the market plummeted, this trader bagged $160 million, sparking speculation over market manipulation — with some even theorizing that the “whale” behind the transaction was close to the presidential family itself.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments